_0.png)

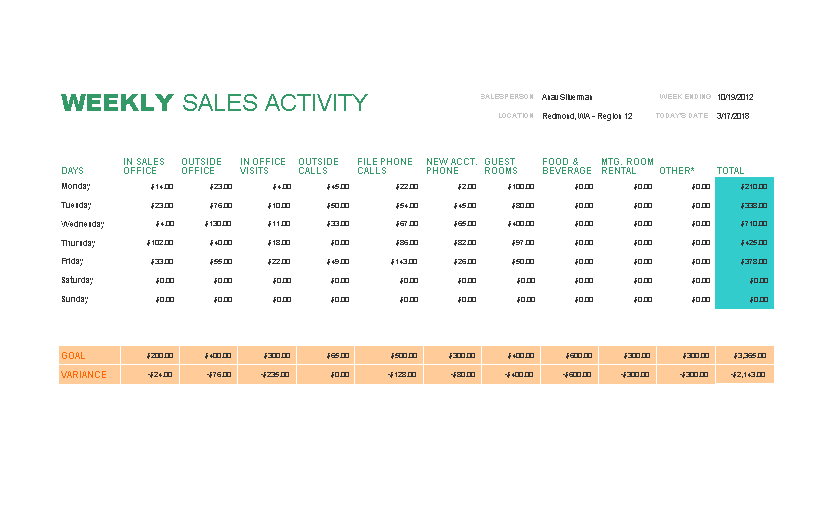

We can interpret the inventory conversion period as determining the number of days one can convert the inventory into sales to assess the average cash cycle and manage it better. Ultimately, the company has to convert inventory into sales hence, sales are the base for calculating the conversion cycle. It is because it helps readers of financial statements to understand better. In comparison, it is also a fact that the analyst calculates this period by considering sales. Hence, some organizations do not take the average sales while calculating this period to determine the exact conversion period. It doesn’t include any other expenses into account except the cost of goods sold.

read more for the year would be taken into account so that every reader could understand the analysis and compare it with the industry conversion ratio.Īs sales price, less cost of sales is the gross profit margin Gross Profit Margin Gross Profit Margin is the ratio that calculates the profitability of the company after deducting the direct cost of goods sold from the revenue and is expressed as a percentage of sales. read more, the net sales Net Sales Net sales is the revenue earned by a company from the sale of its goods or services, and it is calculated by deducting returns, allowances, and other discounts from the company's gross sales.

These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. Whereas, for presentation in the financial statement Financial Statement Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly). The cost of sales and average daily sales would be taken as a base for internal calculation purposes to know the exact conversion period. It is based on the accounting equation that states that the sum of the total liabilities and the owner's capital equals the total assets of the company. Inventory is taken as on the balance sheet Balance Sheet A balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. Source: Inventory Conversion Period ()įormula = Inventory / Average Daily Sales

#AVERAGE DAILYSALES HOW TO#

You are free to use this image on your website, templates, etc., Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked read more and improves the conversion period through efficient management and working on loopholes.įormula = Inventory / Cost of Sales * 365 It considers the days inventory outstanding, days sales outstanding and days payable outstanding for computation. The number of days or months the inventory converts into sales determines the cash conversion cycle Determine The Cash Conversion Cycle The Cash Conversion Cycle (CCC) is a ratio analysis measure to evaluate the number of days or time a company converts its inventory and other inputs into cash. What is the Inventory Conversion Period?.

0 kommentar(er)

0 kommentar(er)